Your car might break down right before payday hits your account. It may happen that the heating system will decide to take a break during the coldest week of the year. You could receive a pile of medical bills without any indication. Such unexpected expenses have the power to affect your planned budget for the whole month.

Short term loans from the direct lender can help when your bank balance says “not now.” They provide the interim between what you need and your payday. You will not spend months waiting weeks to get an answer, as in the case of bank loans. The majority of providers are making snap decisions, and they are quick and prompt. Others even send the cash directly to your account on the same day.

The papers required for these loans will not cover you with work. A valid ID, evidence of residence, and pay slips usually work wonders. The entire process bypasses the red tape that retards large loans. These instant cash remedies will get you even without the years of debt. You make you borrow weeks or months, not years, as is the case with big loans.

Borrow Only What You Need

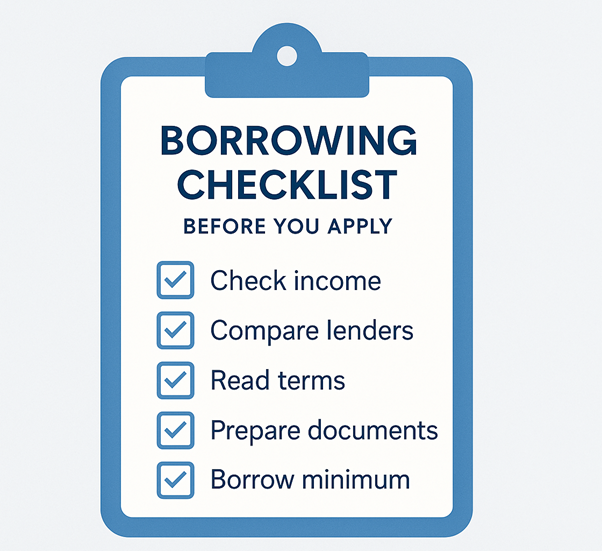

Money troubles hit us all sometimes. You work out exactly how much cash you need first. You can look at your bills, count your costs, and figure the final sum. Taking more than needed creates bigger problems down the road. Many people grab extra “just in case” but end up stuck in debt.

A short term cash loan can help with sudden bills or costs. These loans work best when used for real needs only. Never use these loans for wants like holidays or shopping sprees. You can keep your eyes on solving the real problem at hand.

Your budget matters more than ever during loan times. Can you pay back what you borrowed next month? You can map out your cash flow before signing any deal. Smart borrowers know their limits and stick to them firmly. Loan firms offer loans to see what your payments might be.

- Always count all costs when planning your budget

- Break down expenses into needs versus wants

- Take time to cool off before making final choices

Compare Lenders for Best Terms

Some charge high fees while others offer fair deals. Many lenders still provide low-rate short-term payday loans. You can shop around and check at least three places before you decide. Online lenders might work faster when time matters most.

You can look beyond the big rate number they first show you. Ask about late fees, early payment charges, and hidden costs. Many lenders show all costs up front with no tricks. Some firms hide extra fees in small print, so read with care.

You can check what past users say about their loan firm. Look for firms with clear terms and kind staff. You avoid places with loads of bad reviews or legal troubles. The right lender will explain things in plain talk.

- Ask friends who they trust for quick loans

- Check if the lender reports to credit bureaus

- See if they offer payment grace periods

- Look for firms with proper licenses

Your loan choice can help or hurt your money health. You can take time to find terms that fit your life. Many lenders now offer quick checks that won’t hurt your score. The right loan helps you solve today’s problem without making tomorrow worse.

| Responsible vs Irresponsible Borrowing | ||

| Aspect | Responsible Borrowing | Irresponsible Borrowing |

| Purpose | Medical or rent emergency | Shopping or vacation |

| Amount | Based on real need | Borrowing more “just in case” |

| Repayment | Planned and on time | Missed or delayed |

| Decision | Based on budget | Emotional or rushed |

Check Eligibility and Repayment Ability

Before you rush to get a loan, know what lenders want. Some need you to earn a certain amount each month. Others look at your job status or how long you’ve worked there. Your credit score plays a big part in their choice. Some places will still help even with a poor credit history.

You list all your bills and costs that must be paid monthly. This tells you what you can truly spare for loan payments. Many people skip this step and face tough times later.

Your daily needs must always come first in money choices. If loan payments would mean skipping meals or missing rent, stop. Find other ways to solve your cash problem instead. You can talk to those you owe money to about payment plans. Most companies prefer getting paid slowly rather than not at all.

Missing loan payments hurts more than just your wallet. Your credit score takes a hit with each late payment. This makes borrowing harder and more costly for years. Some lenders report late payments after just seven days.

- Ask if the lender offers payment grace periods

- Check if early repayment has any fees

- Look into whether the lender reports to credit agencies

Use Short-term Loans Responsibly

The short-term loans best serve real urgent needs that can’t wait. The key test: Is this need truly urgent and needed?

Paying loans back faster saves you real money in fees. A week early can cut down what you pay. Many lenders charge daily or weekly interest on short loans. They can also offer a short term no guarantor loan. You can check if your loan allows this without extra fees.

A small cash cushion prevents future loan needs. You can start small if you must; even just £5 each week helps. This grows over time into your own emergency fund. Your own money never charges you interest or late fees.

- Set phone alerts for payment due dates

- Keep loan papers in one easy-to-find place

- Tell lenders early if payment problems arise

- Split emergency costs where possible with friends or family

Smart borrowing means planning your exit from day one. Know exactly when and how you’ll clear the debt. The best loan is one that solves your problem without making new ones.

Conclusion

The best choice helps solve today’s money worries without making new ones. You always read the fine print before you sign any loan papers. You can know exactly what you’ll pay back and when it’s due.

These loans work best as rare helpers, not monthly tools. They shine in pinch moments when other options won’t work. Your money health matters more than quick fixes. Short-term loans can help when used wisely with clear payback plans. They give breathing room during tough spots but need careful handling.