Do you wonder what good using loans can do? It is the basic question for those starting their financial journey. Individuals starting their higher educational life wish to exercise financial freedom.

If you feel that “I want to be financially independent and manage my expenses”, then you have landed right. The journey to accomplishing this goal begins with having a credit score. Having and regulating one may help you ensure a healthy financial lifestyle. The blog states the best reasons to use credits and build your credit score.

How does taking up credit help you as an 18+?

The way you manage your money at university affects your later life finances. Your credit score begins when you get your personal bank account. However, it would not help if you use it temporarily and depend largely on the guardian’s help.

Instead, use it for any possible expense, like paying the rent or a mobile phone bill. It then helps you create and build a credit history. A positive credit history helps qualify for better rate loans, mortgages and credit cards.

You may not know this, but you can get quick cash as a student despite having just a bank account and part-time income. Let’s understand this:

1. Helps you get a telephone connection

Getting a telephone connection is challenging if you lack a credit history. It is because the telephone provider lacks sufficient information on the person regarding financial bill management. However, having a valid bank account may help you get a telephone connection. Using the same account for the bill payment helps you build a credit history.

If you don’t get the part-time income on the specific date, don’t panic. You don’t need to skip the telephone bill. Some loans are easy to get with a bank account and income. You can check quick loans and pay the dues instantly. Don’t worry, it would not affect the credit improvement. You just need to choose a valid repayment structure.

2. Helps you get better at budgeting

If you have been struggling with managing finances as a student, the loans may help. Just for once, replace overdrafts with easy loans. You may use overdrafts for small bill payments, but it is not good for the long term. It is because an overdraft is a high-interest debt. Alternatively, affordable short-term loans may help you with the same purpose.

However, here you pay far less than the overdraft. The loan grants you the scope to get better at budgeting. For example, if you take a loan of £1500 and split it into easy and equal monthly instalments, you get smart with management. It requires you to save and pay a specific amount. Thus, you get better by reducing unnecessary expenses and funding the essentials.

3. Understand cheap funding options

Unlike short-term personal loans, you can get any loan for your situation. However, you would not know this unless you get a loan for any small need. It is not about taking a loan without any purpose. But you can pick when in need of urgent cash.

It will help you understand the possibilities to reduce the interest costs. For example, you cannot get a loan if you don’t have a basic income source. It is against the standard codes of lending and borrowing. In this case, if you don’t have a basic income, you must provide security to get a loan.

For example, you may get emergency loans with a cosigner on board. A co-signer is equally responsible for the loan payments. In this case, the cosigner must have a regular income to support the instalments. It may help you get an instant loan for an urgent purpose.

4. Determine the “red alerts” for bad credit

Every individual has a unique financial structure and liabilities. As an 18+, it is difficult to distinguish between credit-friendly and credit-affecting expenses. For example, taking a personal loan to pay the rent is credit-friendly.

However, using credit cards by extending the limit affects your credit score. You may not know this fact. You will not know it until you use and personally experience the financial option. Accordingly, you will get to know that:

- Fetching a loan at the lowest APR is affordable

- Borrowing only the amount that you can afford is a “credit-friendly” approach

- Choosing the right repayment helps reduce the possibility of loan defaults

- Setting direct debits helps you avoid skipping a payment

5. Explore options to get a loan without a credit history

Yes, you may get a loan even if you lack a credit history. However, the payout is lower on such loans. It is because the student lacks sufficient credit history for the loan provider to analyse the affordability. Thus, minimal information on the borrower’s part increases the risk for the person. However, you may still get financial assistance for any purpose.

Check loans for 18 year olds with no credit history online. Explore the requirements and criteria that you must meet to get a loan. Generally, getting a loan without a credit history is challenging.

However, you may get loans like doorstep loans, payday loans, as these do not require you to have a credit history. Alternatively, you can get a guarantor to get a loan online. He acts as a guarantor on the loan for the repayments. He could be any person, like- father, mother, brother or wife, who may support you to qualify for a loan.

7. Achieve lifestyle goals timely manner

Every individual shares life goals like buying a car, a mortgage or starting a business. You, too, may have some life aspirations that you want to fulfil. Knowing the personal loan options, how they work, and the ways to fetch reduced interest rates helps you. Accordingly, you check and report the errors on a credit report. It improves your credit score and makes you eligible for loans.

Similarly, the eagerness to buy a home through a mortgage will make you explore more deeply. You will know the ideal credit score to achieve before applying, red flags that may affect the loan approval and deposit requirements. Knowing such aspects would help you plan the aspects. It thus smoothens the route to improving your financial lifestyle.

Bottom line

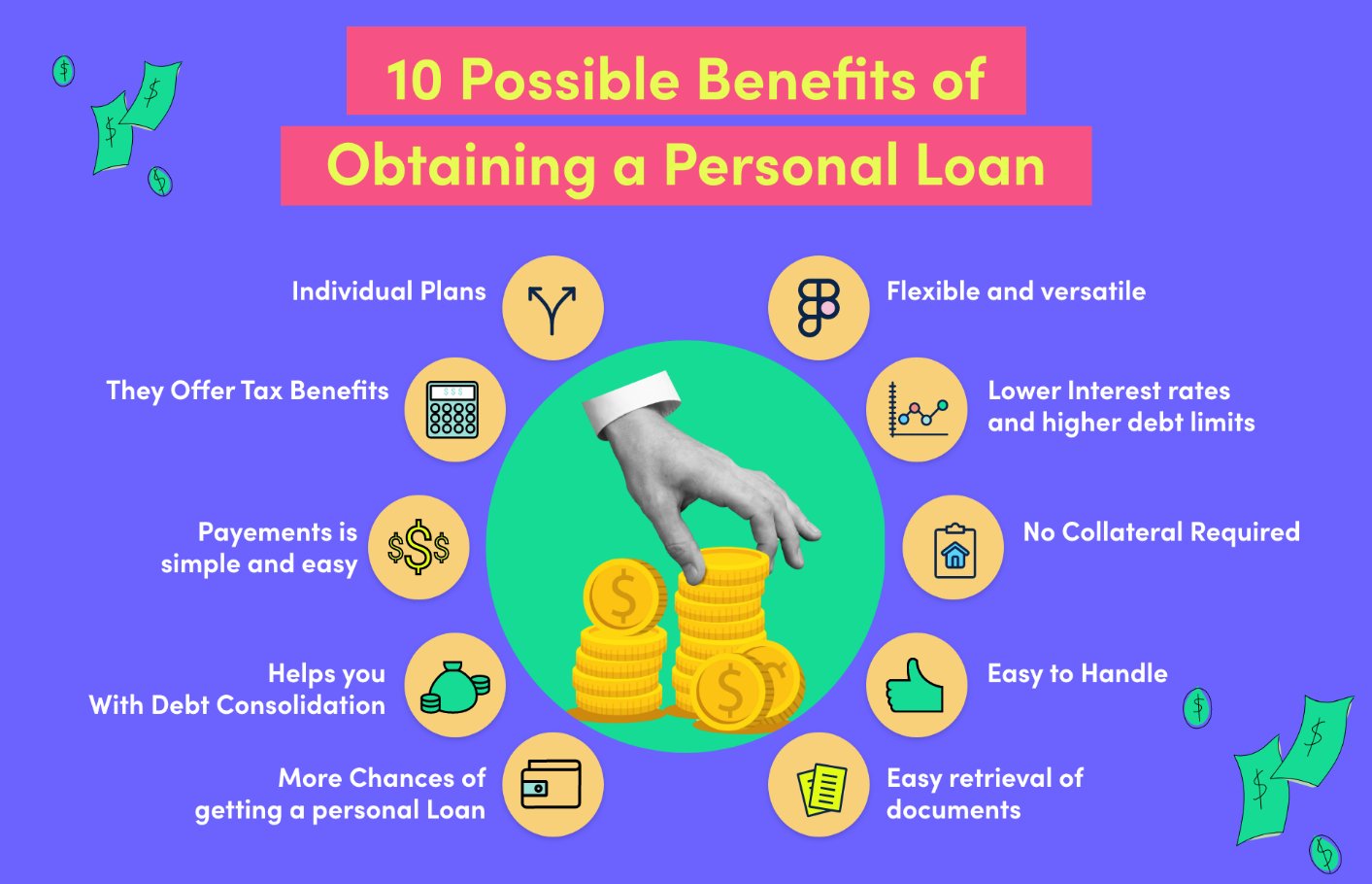

These are some specific reasons that taking a credit may help the youngsters. Personal loans may help you start your credit and financial journey. However, always be conscious while taking any loan. Read through the terms and check whether it is ideal for your needs. Additionally, a loan helps you build a credit history which may make you eligible for affordable credit cards, loans and mortgages.