Loans are needed to fill the gaps in cash requirements due to savings. They assist individuals in buying houses, sending kids to school, or starting small businesses. You then can risk something to lose or trust in your good name.

The collateral loans require you to use your assets as security for the loan. The lenders will be assured that they can claim something in case payments cease. These usually make it easier to negotiate more favourable conditions on your behalf and at a reduced cost. This is a path that is taken by many individuals in the process of buying homes or initiating major projects.

The other path needs no backup. These collateral-free options look at your money habits. A strong credit score and steady job often unlock these options. This can be for many working people today. These are sort of no guarantor loans, where you don’t need any guarantee of assets to get loans.

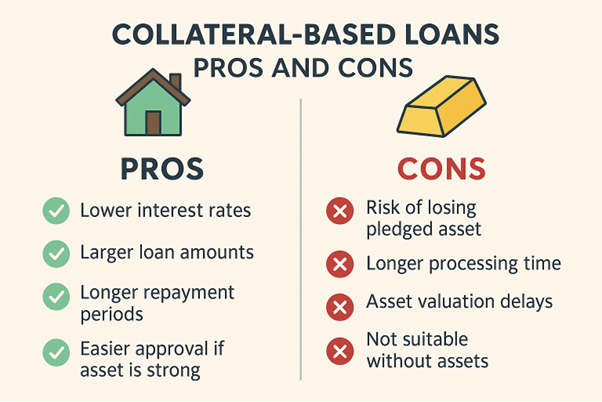

What are Collateral-based Loans?

Collateral-based loans ask you to put something valuable up as collateral to get these loans. You offer an asset as security, and the lender feels more certain in lending you money. This setup creates a security net for the lender if you are unable to repay the borrowed amount.

Your home might serve as backing for a mortgage. You can also operate your cars for vehicle loans. You can even use gold jewellery or land to secure these financial arrangements. The item’s value typically needs to match or exceed what you’re borrowing. Lenders carefully review this information before approving your request.

The secured loans have low interest rates. The lenders face less risk when they can claim something if payments stop. You might get more cash and longer to pay it all back. The terms often feel more relaxed because the bank knows they won’t lose everything.

You can’t miss any payments, as failure to do so may result in the forfeiture of your collateral. Your car could be towed away if you fall behind.

- Application processes tend to move faster

- Approval chances improve significantly

- Payment plans stretch over many years

- Credit scores matter less with backing

- Early settlement might trigger extra fees

These arrangements work best when you feel confident about a steady income.

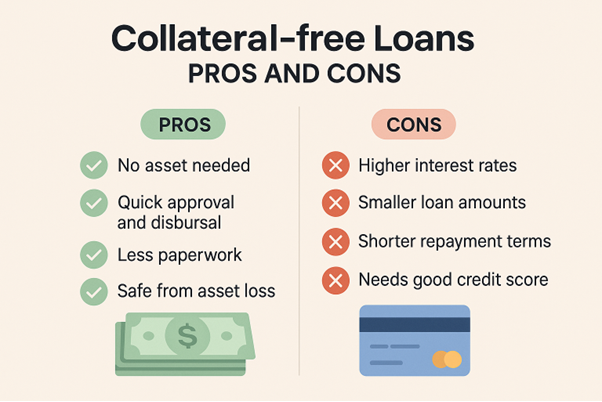

What are Collateral-free Loans?

Collateral-free loans don’t ask you to put up anything to get loans. The lenders check your money habits instead of asking for assets. They look at how you’ve handled past debts before saying yes.

Your salary plays a huge role in these choices. The lenders want proof that you earn enough to make payments. They need your job history and monthly income. Your credit scores matter more here than with backed loans. Your past money moves tell lenders what to expect. Any late bills or missed payments might shut down your chances.

The cash amounts are quite low without backing. Most lenders cap these loans at lower figures. You might get a few thousand pounds rather than tens of thousands. The payback time usually shrinks down too. These come with high interest rates.

- Approval might happen within hours

- No stress about losing family treasures

- Less paperwork means quicker cash

- Students and young workers can qualify

- Moving homes won’t affect the deal

These options work well for quick needs or small goals.

Main Difference Between the Loans

You can back your loan with something you own, or trust your money record to get loans. Both options serve different needs and come with their own mix of good and bad points. The right pick depends on what you need, what you have, and how you handle risk. Let’s break down how these loan types differ.

Interest Rate Comparison

The cost of borrowed cash varies widely between these options. The backed loans tend to save you money over time through lower rates. The lenders feel safer when they can claim something if you stop paying. This safety lets them charge less for the service. A home loan might cost just 3-5% yearly, while credit cards often reach 20%.

Loan Amount and Tenure

How much money can you get? You can get your desired amount with backed loans. Your home might secure hundreds of thousands of pounds for buying or fixing property. These loans give you many years to pay back what you owe. You might get just a few thousand pounds with tight payback times without backing.

| Use Cases | ||

| Situation | Collateral-based Loans | Collateral-free Loans |

| Buying a house | Suitable | Not suitable |

| Business expansion | Suitable | Limited use |

| Medical emergency | Not ideal (slower) | Very suitable (faster) |

| Education abroad | Suitable with asset backing | Limited by loan size |

| Travel or small need | Not ideal | Best suited |

Risk Factor for Borrowers

The stakes change greatly depending on your choice. Putting your home on the line means real danger if times get tough. Missing payments could leave you without a roof over your head. Unsecured options keep your things safe, no matter what happens. The worst case shifts to debt chasing and court orders instead of lost property.

Processing and Approval Time

Need money by next week? The backed options move slowly as banks check what you’re offering. They inspect homes, value cars, or weigh gold before saying yes. The lenders need to see papers, and weeks might pass during this process. The unsecured options often put cash in hand within days or even hours.

Eligibility Requirements

Getting approved follows different paths for each loan type. The backed loans care most about what you own and its value. Your credit might matter less if your home is worth plenty. Without backing, your money habits take centre stage. The lenders check your credit score, job history and monthly pay very closely.

Suitability for Different Borrowers

The asset-rich borrowers have more advantages with backed loans. They can be homeowners, car owners, and gold owners. Many young workers without major assets fare better with unsecured options. Their steady jobs and clean money records help them qualify despite owning less.

Conclusion

The smart borrowers look beyond just getting quick cash. They think about the total cost over the years and their ability to pay. They match their current life phase with the right financial tools. This leads to better money choices overall.

All loans come with firm promises to pay back. Missing payments hurts your money record, no matter which type you choose. The best loan serves as a helpful tool rather than a burden. Both types help people move forward with their dreams and plans when used wisely.