Imagine a case:

You are checking your monthly bills to know your budget and make space for the big life moment- Wedding. You check incomings, outgoings, and emergency expenses for the month. While checking it, you spot an unpaid utility bill with the last date. You are late, as the very day is the date by which you must settle the dues. You panic, as not paying one may mean paying extra. You are not ready for this, given the additional wedding expense. What would you do?

Explore the best emergency loans online and apply. You get the cash in the account without documentation and collateral. It proves the biggest relief as you want the money quickly. You immediately pay the bill online as you get the cash in a specific bank account. Thus, by acting quickly, you can avoid fees like late bill payment penalties. Also, you are relieved as your credit score didn’t drop.

Just like this scenario, you may encounter an urgent cash need anytime and from anywhere. You may not be financially ready for that. Thus, a few loans, like the emergency ones, may help you. If confused, regarding the purposes and which loans to apply for in case of urgency, read ahead.

What loans can help you in case of a crisis?

Instant cash loans are financial facilities that one may tap to meet time-sensitive requirements. One can get the loans approved instantly without guarantor or collateral. It automatically reduces the loan turnaround times, and you get one on the same day! Just understand the purpose and apply according to the amount requirements. Here are the loans to apply for in emergencies:

Bad credit loans

These are unsecured and secured loans that you can access for emergencies. These are specifically for individuals with past credit mistakes seeking urgent cash. Acquiring a loan acceptance with bad credit is challenging. Here, loans for bad credit history come in handy. You may get it quickly than a traditional loan. Individuals with consistent income and fair financial management may get bad credit loans at low interest rates.

| Pros of bad credit loans | Cons of bad credit loans |

| You can use the loan for any small purpose, including paying off the overdraft bill. | Interest rates are high on bad credit loans, making borrowing expensive. |

| Consistent loan payments help you repair and rebuild your credit history | Missing a loan payment may affect your credit score further |

| High chances of loan approval in comparison to traditional loans | May end up in a debt trap due to the ease of availability. |

Unsecured loans

An unsecured loan is a financial product that does not require one to provide collateral. Instead, the prime approval is based on the person’s credit score, income, and financial management. You may get up to £25000 on unsecured loans for any of your needs. You can use it for any urgent cash needs, like:

- Repairing the loft

- Clear the suppliers’ payment as a business owner

- Pay urgent medical bills

However, the interest rates stay higher than those of a secured loan. It is a perfect outcome for individuals with a good income and low assets.

| Pros of unsecured loans | Cons of unsecured loans |

| Helps you split the cost of purchase into manageable monthly instalments. It eliminates the waiting time to acquire a goal. | Skipping a loan payment and paying it later may attract late payment penalties. |

| Helps you consolidate debt without sacrificing assets. Paying a good portion of your debt boosts your credit score. | Interest rates are high for shorter-term loans or those needing a large sum. |

| Offers flexibility in borrowing limits and repayment tenure. | One must have a satisfactory or fair credit score to obtain funds. Otherwise, you may be required to provide a guarantor. |

Bridging loans

Bridging finance is a cash loan that you may take to bridge the amount to renovate or purchase a commercial or residential property. The amount stays high here for up to £5 million for any of your needs. You may get quick bridging loans for scenarios like buying a property at auction. Also, you may get it for:

- Downsize into a smaller one by selling one property

- Buy a new home on a changed timeline or urgency

- Extend the deadline of the interest-only mortgage

You can get the money within 24 hours to clock that property in your name. It is guaranteed against an asset that you own..

| Pros of bridging loans | Cons of bridging loans |

| It alleviates gaps in funding a huge amount while buying, selling, or renovating a property. | The convenient bridging finance comes with high interest rates and costs. However, borrowers can also repay interest at the end. |

| Helps you purchase properties with an ineligible for regular mortgages. | You cannot get the bridging loan without providing a good exit strategy. ( Explain-How will you clear the dues?) |

| One can exit early from a long-term secured loan, like a bridging loan. It helps you save money on interest costs. | These are secured loans, and hence if you are unable to repay the loan, you may lose the collateralised property. |

Frequently asked questions

These are some loans that you can use in emergencies. You may have some queries regarding the fast cash facilities. The following user queries may answer that:

Can you get a fast loan with no credit check?

No, getting a loan without a credit check is not possible. Responsible lending companies conduct basic assessments to gauge the borrower’s affordability. It is important as it helps the borrower borrow only the amount that they can afford to repay without affecting the basic budget. The check does not affect the credit score at the time of the loan application.

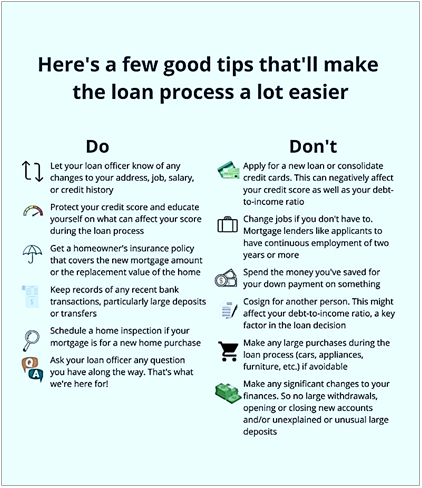

How to avoid risks associated with quick loans?

One of the greatest threats is the temptation to borrow more due to the ease of availability. Keep your instincts in check and borrow only according to what you can afford. It helps you avoid paying more as you may default on the loan payments. Alternatively, always partner with a reliable loan company to eliminate loan fraud.

How to pay off a loan responsibly with bad credit?

The interest on fast loans stays competitive. It may mean paying more if you miss a payment. Therefore, create a budget and set direct debits for the payments. If you cannot pay, contact the loan provider for a solution.

Bottom line

These are some loans that you can get quickly for emergencies. Identify and compare the costs before applying for a loan. Check for additional fees and hidden payments. Keep your documents ready and provide the latest ones to get a quick loan.